Banks and home loan lenders are failing to offer loyal customers the best rates, meaning they’re missing out on thousands of dollars in monthly savings and cashback offers.

That’s the conclusion reached by personal finance marketplace and advice company Compare Club based on new data.

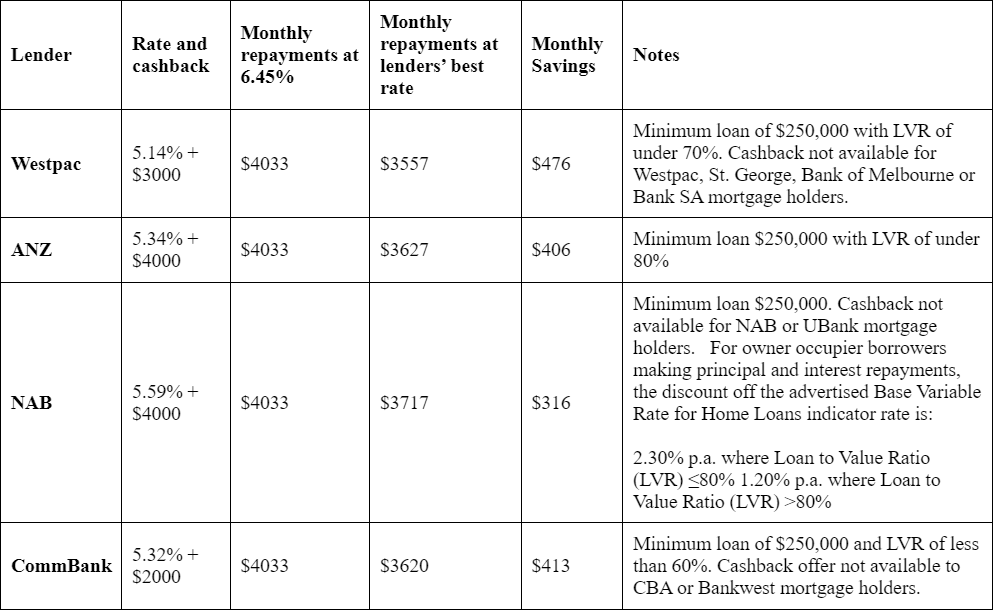

Refinancing inquiries to Compare Club showed that homeowners on a 6.45 per cent variable rate with one of the big four banks could be saving an average of $404 a month in mortgage repayments if they were moved to their lender’s best rate.

Big four rates

In addition, the big four comprising ANZ, Commonwealth, NAB and Westpac are all offering new customers cashback deals of about $4000. These aren’t available to existing customers or homeowners with less than $250,000 left on their loan, meaning loyal customers are potentially missing out on getting around $2404 back into their bank balance.

An eligible homeowner with a $600,000 25-year principal and interest no fee mortgage on a variable rate of 6.45 per cent could save $476 a month and get $3000 cashback by moving to Westpac’s lowest variable rate of 5.14 per cent, while moving to ANZ could net them a $406 monthly saving and $4000 cashback. These cashback offers aren’t available to existing customers.

“Our first piece of advice to homeowners is always to speak to your lender and see if they can lower your interest rate. But this data really shows the cost to Australian households who don’t shop around,” said Compare Club CEO Lance Goodman.

“Our brokers are also finding that, for existing mortgage holders, lenders will rarely match the best rate that they’re advertising to new customers unless the homeowner says they’re switching banks. It means that mortgage holders have to often go through long negotiations just to be treated the same as a new customer.”

Out of pocket

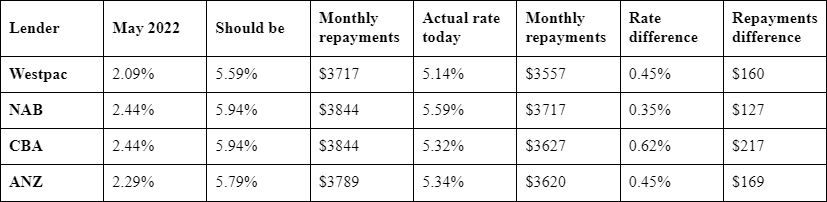

The data also shows that if a customer managed to secure a loan with the best possible variable rate with any of the big four banks in May 2022, when the RBA first started raising interest rates, they would still be out of pocket by an average of $168 per month after the cash rate rises less than a year later.

“Sadly, lenders’ loyalty tax starts almost from day one. On average, the best rates of the big four should be 0.47 per cent lower than they currently are, if Westpac, ANZ, CBA and NAB applied the same cash rate to loans for new customers as they did to their existing ones,” Mr Goodman said.

“Existing customers who prudently refinanced their loans before the cash rate got too high can feel particularly hard done by.

“They may still be able to negotiate down to their lender’s lowest rate, but they’re not eligible for cashback offers, even though they’ve been responsible with their finances.

Loyalty tax

“At a time when Australians are feeling the pain of 10 consecutive interest rate rises, there really is little incentive for mortgage owners to stay with their current lender. This is especially true for the 800,000 homeowners who are moving onto variable rates this year and are likely to get hit with a loyalty tax on top of a massive hike in monthly repayments.

“An extra few thousand dollars in the pocket would be a huge help to most households right now and refinancing is one of the best ways to help make your bank balance look a little healthier.

“Lenders are falling over themselves to entice new customers and some of the offers in the market are really attractive,” Mr Goodman said.

“It’s why we’d recommend engaging a broker who will have access to a wide range of refinancing packages. By exploring your options and comparing deals, you may be able to find a home loan that not only offers a better interest rate but also comes with added benefits like cashback.”

Average savings on lenders’ best rate on a $600,000, 25-year P&I owner occupied no fee 6.45 per cent variable rate loan. Correct as of 31.03.23

Rates now vs May 2022

YourLifeChoices is owned by Compare Club

Have you ever switched a loan to get a better rate? Was it an easy process? Why not share your experience in the comments section below?

Also read: Beware of this new breed of bank scams