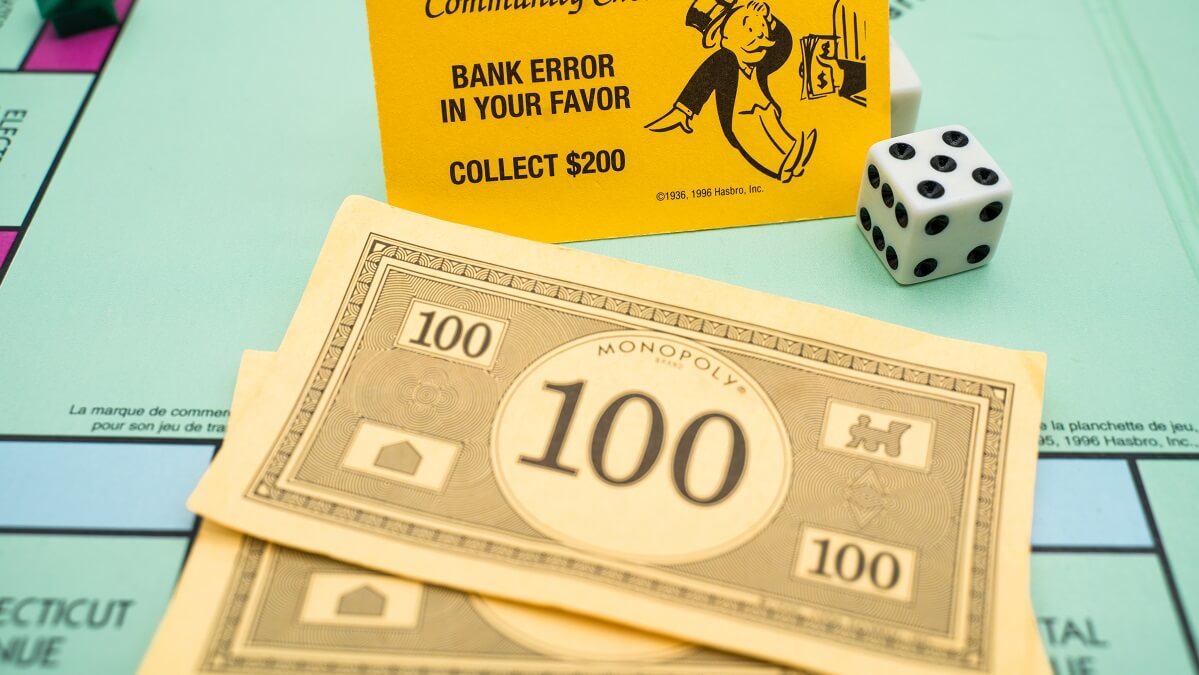

If you’re like a lot of Aussies over 50, you’ll remember spending seemingly endless hours in the school holidays battling for financial supremacy while playing Monopoly. And you’ll probably recall the feeling of joy when you turned over the ‘Bank error in your favour’ card. $200 out of nowhere could be enough to get you the win and bragging rights!

Such errors can and do happen in real life. What should you do if you happen to get lucky and suddenly find yourself with more in your bank account than you know should be there?

In reality, if you are lucky enough to be on the receiving end of such a windfall, it will more likely be an error of the payer rather than the bank that is the cause. Whatever criticism you might have of large financial institutions, they’re pretty good at avoiding errors that see them, rather than you, losing out.

Read: Banking sector in transition – whether you like it or not

So if you do happen to find an unexpected bonus in your account, and you’re tempted to make use of it, keep in mind that there’s probably someone out there who’s accidentally transposed a BSB or bank account number, and who may well be in a state of panic. (In fact, I have been that person! It is not a nice feeling.)

The second thing to consider is the likelihood that the error will be uncovered at some point, and the bank and/or your accidental benefactor will seek to recoup the misplaced funds. That might not happen for a significant period, but the length of time the money sits in your account has no impact on your claim to its ownership.

According to the Australian Financial Complaints Authority, money that is transferred into your account by mistake is not legally yours and you will have to pay it back.

Read: Simple ways to protect yourself when doing your day-to-day banking

There have, of course, been cases of beneficiaries who were ignorant – wilfully or otherwise – of the laws and chosen to spend their windfall. In most cases, it does not end well for them.

One such case was a Melbourne woman, Thevamanogari Manivel, who in May last year received a mistaken transfer from cryptocurrency trading platform, Crypto.com, for an amount in excess of $10 million!

The error apparently occurred as the result of a manual error, in which Ms Manivel’s eight-digit account number was entered into the ‘amount’ field. Oops!

Read: Banking recommendations fall victim to credit-fuelled COVID recovery

By the time the error was discovered, Ms Manivel had allegedly used some of the funds to purchase a $1.35 million property. The matter was taken to court, and Ms Manivel was ordered to sell the property in order to repay Crypto.com part of the outstanding money, as well as interest and costs.

If you do happen to be a ‘victim’ of an unknown credit into your account, your best course of action is to immediately contact your bank/financial institution. Although that will most likely result in the bonus disappearing almost as soon as it arrived, you can at least take solace in the fact that you’ve allowed your accidental benefactor a huge sigh of relief.

And from a legal standpoint, doing the right thing will prevent what appears to be a dream scenario from turning into a nightmare.

Have you ever had an unexpected amount land in your bank account? How did you deal with it? Have you ever transferred money into an account in error? Was it easy enough to get it back? Why not share your thoughts in the comments section below?

If I get some extra $$$ on my account that do not know where it is coming from, I will immediately transfer all the money to my savings account and earn interest and keep the interest and return the money when the bank asks for and that may be a few days, weeks or months ??? – so I suggest keeping a savings account always available, you never know when you could get lucky he he he he

Legally it is the responsibility of the account holder to advise the bank of any irregularities that they may observes happening in their account. If you use any of that mystery deposit for personal gain, you may be charged with theft, in addition to have to make full restitution (including costs of recovery).

If the error has occurred due to an administrative mistake within the bank, they do not want this known in the public arena and will hope that the error can be remedied quickly and quietly.

If you are in the habit of transferring funds around using direct debit and credit it is probably better to use dedicated accounts for this and only use them for that purpose and keep your personal banking completely separate at all times.