Banks are meant to be trusted entities, but are they doing enough to protect you from fraud?

Earlier this week, I noticed an $847 payment pending in my bank account. It was for a website hosting plan that I no longer wanted, and allowed to lapse at the end of the financial year. I spoke with the hosting company, which, though aware that I no longer wanted the plan, somehow still saw fit to try to bill me even after the plan had expired and was not renewed.

I contacted by bank, which is usually very good about these things, and asked that it hold the payment. I was told it could not hold a pending payment, even if it was under scrutiny.

My response was: “That’s unfortunate. No protection?”

I didn’t get a reply. My bank would not protect me from a dodgy transaction. My only recourse was to lodge a protest after the money was withdrawn from my account.

Luckily, I was able to find a customer service agent from the web host who was able to go through my chat/support history and see that I had proof the account was expired and that I did not want it renewed. Thankfully, the pending payment was suspended and I got my money back.

Popular plans right now

I’m one of many Aussies who has been (or was close to being) a victim of some sort of banking fraud.

Banks are, historically, highly trusted. Most of us are confident that our bank will protect us in case of fraudulent activity.

But a new study shows customers want banks to do more to protect them and expect investment in improving security features.

The study shows that:

- one in five Australians have fallen victim to banking fraud

- one in four Australians know someone affected by it.

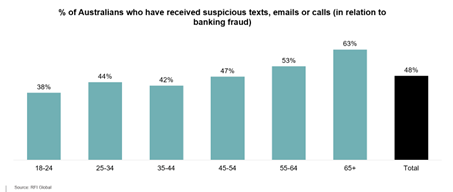

Latest research from RFI Global shows older Australians are particularly vulnerable, with 63 per cent receiving suspicious communications from scammers impersonating government institutions such as myGov and the ATO.

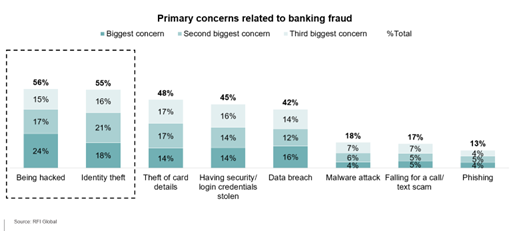

Being hacked and identity theft are the two biggest concerns, followed closely by credit/debit card details theft and critical security and login credentials being stolen.

RFI discovered that customers expect more of financial institutions when it comes to managing the increasing incidence of fraudulent incidents.

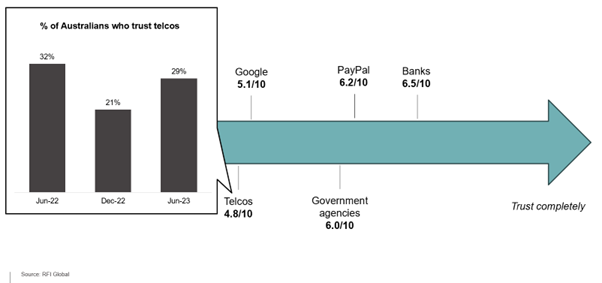

“Although banks enjoy a highly trusted position among their customers, trust can be easily lost,” states the report. “RFI uses the example of telcos’ sharp and steep decline, following the much-publicised data breaches at the end of 2022, as an example of how quickly sentiment can shift.”

Customers want more education and communication

RFI says that although consumers have confidence their bank will support them in a fraudulent incident should it occur, they think banks could do more to educate customers in advance to avoid the situation altogether.

While 78 per cent believe their bank’s security measures are adequate and 66 per cent trust their bank to protect them, a significant 75 per cent feel banks should do more to educate customers about fraud prevention.

The dangers of digital banking

Perception of security and safety influence how a consumer chooses to bank. And while some may be sceptical of online security, digital banking continues to grow.

Three out of four Australians use digital banking weekly, with the use of mobile banking not far behind.

In the case of a fraud, customers want to discuss actions with a real person, so customers want call centres to play a critical role.

What can banks do to improve confidence?

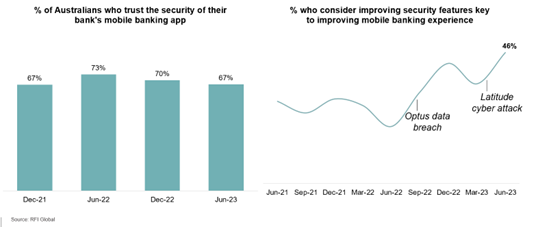

Customers expect their financial institutions to invest in improving security features, but not at the expense of user experience.

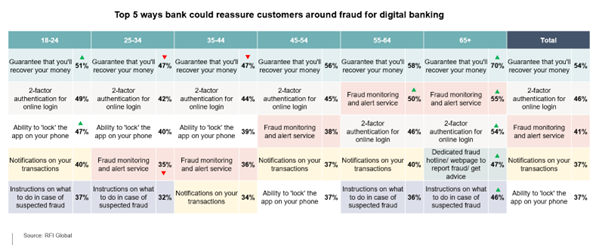

RFI found that what customers really want is a guarantee that their money will be recovered after fraudulent activities.

“There are many ways financial institutions can bolster security,” says RFI. “But this must be weighed up against user experience. There are many ways to reassure customers around fraud for digital banking, but nothing trumps a guarantee that a customer will recover their money in a worst case scenario.

“With increasing fraud and scams against Australians, it seems the challenge is for the Aussie banks to protect their customers from fraud and invest in improving security features … all the while balancing these necessary considerations without compromising on experience.”

What can your bank do to increase your confidence in online or mobile banking? Why not share your thoughts in the comments section below?

Also read: Bank customers a step closer to protection from scams?

The banks need to have enough human support staff, preferably Australian, so as to deal with fraud complaints in a timely manner.

Apart from that be careful what you do online and when available use Paypal to purchase items or services. Paypal seems to have better fraud prevention measures in place than the banks have. And never buy anything advertised on Facebook as from what I have seen most of their adverts are fake.

I recently had my computer and devices hacked late on a Friday afternoon which resulted in my bank accounts being emptied. The financial institution I am with whilst it has 24hr monitoring services on card fraud it does not have the same protection on bank accounts. I was only able to call an afterhours number and leave a message for a call back on the Monday when the bank reopened. I have been told it will highly unlikely that I will be reimbursed for the lost money.

Hacking is does not discriminate between ages so it is right across the board and young middle and elderly age groups are all being affected and their privacy and security is being violated.

My concern is that the Government is now pushing for a cashless society and our right to have choices in the decision- making processes of how as individuals we maintain our finances are being eroded away. Businesses, Financial Institutions and Governments are all strongly advocating for society to embrace internet banking and transactions.

I have found during the process of reporting the fraud that cyber security in a number of areas and departments is seriously lacking and there no tangible strategies to be able to combat the sophisticated frauds/scams/hacks that are occurring on a daily basis.

Perhaps a mandated levy on the profits of Financial Institutions and Big Businesses could be introduced to ensure the security of their customers and their due diligence for accountability is met.

Some banks are and some not. We have accounts with two banks, for historical reasons, one a subsidiary of the other. Interestingly the subsidiary has far better security than the parent company and the parent seems very reluctant to match its subsidiary in terms of multi-factor authentication (MFA) and sms messages whenever money is moved from one account to another within the bank or is transferred out. We do all our banking online from a desk-top for security reasons and the parent bank tells me that I can only have MFA and sms notifications if I instal a bank app on my phone something I refuse because I keep my phone strictly for communication only and it reduces security in the event of phone loss.

As a result I have moved the bulk of our savings to term deposits with other banks and lowered payment limits to the practical minimum to reduce the prospect of fraud.