Superannuation is a highly tax effective vehicle for retirement assets, but it’s a common misconception that benefits exiting the superannuation system will always be tax free in all situations.

Most income and capital withdrawals made after retirement and for people over the age of 60 will be tax free. However, this is not always the case with tax applying to some superannuation death benefits, depending on which family member is receiving a death benefit.

Anyone over the age of 60 planning to pass their wealth to a surviving spouse or to adult children [children over the age of 18 who are not financially dependent on, or in an interdependency relationship with the deceased] must consider the implications of handing down retirement phase income stream benefits to family members on their death.

Who can receive superannuation benefits?

The Superannuation Industry (Supervision) Act 1993 (SIS Act) determines who can receive death benefits directly from a super fund. The act definition captures both a spouse and the deceased’s children, as well as a limited number of other circumstances such as financial dependants and interdependent persons and the Legal Personal Representative (i.e. executor of the estate).

Read: How to make an impact with your charity donation

Superannuation assets do not initially form part of an estate and are not dealt with under a will. In cases where a spouse or a child is the nominated beneficiary, the will is bypassed, and the proceeds are paid to them directly. Only in an instance where the nominated beneficiary is the Legal Personal Representative would the proceeds form part of a person’s estate.

Does tax apply on the death benefit?

Tax can apply to superannuation death benefits depending on the circumstances. Broadly, two factors determine whether tax is applied, including whether or not the beneficiary is a tax dependant and the tax components within the superannuation fund.

What is a tax dependant?

Those classed as a dependant under the Income Tax Assessment Act 1997 (ITAA) will receive superannuation death benefits tax free. To be a tax dependant, an individual is likely to be one of the following:

- a spouse or former spouse

- a child under 18

- a financial dependant or interdependent person.

If an adult child is not captured under the above, then he/she is not considered a dependant under ITAA and tax will apply based on the tax components within the super fund.

Tax components

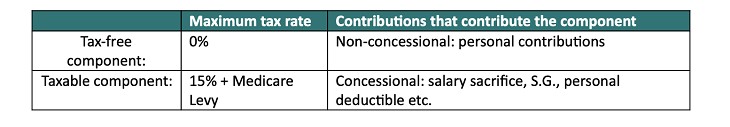

Broadly, superannuation benefits are comprised of the following two components:

- taxable component: tax applies when death benefits are paid to a beneficiary who is not a tax dependant

- tax-free component: no tax applies when paid to a beneficiary.

Tax applies to the taxable component at the following rates.

In some cases, there may also be an untaxed element that attracts the higher maximum rate of 30 per cent. This can arise in certain public sector schemes or where a fund has claimed a tax deduction for insurance premiums paid in respect of the death benefit.

Case study

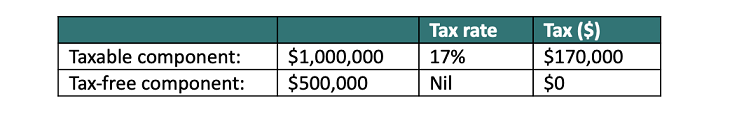

Mary leaves a superannuation death benefit to her adult son Steve via a binding death benefit nomination. Steve has a personal marginal tax rate of 45 per cent, is a dependant under the SIS Act but not under the Tax Act. Mary’s superannuation of $1.5 million contains a taxable component of $1 million and a tax-free component of $500,000. Tax will apply to the superannuation benefit as follows:

This means Steve receives an after-tax benefit of $1,330,000 and has paid an effective tax rate of 11.3 per cent.

Strategies

The following are options worth considering within a broader estate plan for individuals who wish to have their retirement phase superannuation passed onto their spouse or, if there is no surviving spouse, to their adult children.

1. A reversionary pension

A reversionary pension is perhaps the simplest and most effective method to pass superannuation assets to a surviving spouse. In practice, the existing retirement phase income stream transfers to the spouse, retaining most of its characteristics and providing continuity of income payments.

The assets backing the income stream do not need to be sold down, avoiding transaction costs, and they will continue to earn a return in the tax-free superannuation environment.

Read: Could ‘pooled longevity risk’ save your retirement?

The reversionary pension remains a death benefit, so it cannot be consolidated with other superannuation benefits of the surviving spouse. However, the spouse does have access to lump sum withdrawals when required.

After a period of 12 months, the reversionary pension will count toward the beneficiaries Transfer Balance Cap (currently $1.7 million), which means other options may need to be considered in combination with a reversionary pension.

2. Death benefit nominations

Death benefit nominations can be either binding or non-binding on the superannuation trustee, either of which can be appropriate depending on the circumstances. The nomination can be made to either:

Beneficiary directly: The intended beneficiaries are named with specifications on the portion of the death benefit that each beneficiary is to receive. The superannuation benefit is paid directly to the beneficiaries and do not form part of the estate.

Legal Personal Representative: Nominating the legal personal representative means the superannuation benefits will form part of the deceased’s estate and dealt with under the will. This could include directing the benefit into a testamentary trust, to provide the beneficiaries with asset protection and taxation benefits. As the Medicare levy is not paid by an estate, overall tax incurred may be lower when compared with paying directly to adult beneficiaries.

3. Withdrawing from the superannuation environment

Withdrawing may be worth considering, especially if the death benefits contain a large taxable component and would ultimately be paid to adult children.

Caution is to be exercised when considering this strategy as funds withdrawn will no longer sit within the tax-free superannuation environment and generally cannot be contributed back to superannuation easily, if at all. Withdrawing may be appropriate where the funds can be reinvested tax effectively, such as via a trust or individual with a low marginal tax rate.

With forward planning, retirement phase income stream benefits can be transferred to a surviving spouse while retaining the tax benefits of the superannuation environment.

Transferring income stream benefits to financially independent children needs to be more carefully managed. Tax on death benefits can be managed, but the benefits of any strategy need to be weighed up against other consequences and considered in the context of an estate plan that encompasses the whole financial position, including controlled entities.

Read: Financial advice can add thousands to retirement

Unlike any other area in wealth management, it is highly unlikely to be a one-size-fits-all solution to managing superannuation death benefits. Most importantly, the trustee must have a plan in place before the event occurs, taking into consideration who they desire their superannuation beneficiaries to be and the consequences of each option.

It is to be noted that those under the age of 60 or passing superannuation to beneficiaries other than those discussed will have broader implications that need to be considered.

Andrew Wilson is a principal at Pitcher Partners Sydney. He helps clients build passive investment income. Areas of expertise include investment management, tax minimisation, debt management, asset protection, retirement planning and estate planning.

Have you considered and planned for the distribution of your super on your passing? Why not share your experience in the comments section below?