There are a few good reasons 1 July isn’t celebrated with the gusto of 1 January. Despite the lure of a juicy refund, the new financial year task of completing your tax return is one of those reasons for many people.

But what if you didn’t have to, and yet still got a healthy refund into your bank account from the tax office?

In fact, what if that refund was $400-600 bigger for the average taxpayer than what they currently get by hunting through their filing cabinet, or shoebox, for all the work-related expenses receipts?

According to new think tank the Blueprint Institute this is not only possible but also good policy.

“To my mind it’s a no-brainer,” Steven Hamilton, the think tank’s chief economist, said at a tax forum in Sydney.

He was talking about Blueprint’s proposal for a $3000 standard tax deduction for work-related expenses.

It’s a pretty simple policy. Basically the ATO would offer everyone a choice: either do nothing on your pre-filled return and it will apply a $3000 tax deduction or, if you think your work-related expenses were greater than that, you can still claim your deductions by filling out a full return.

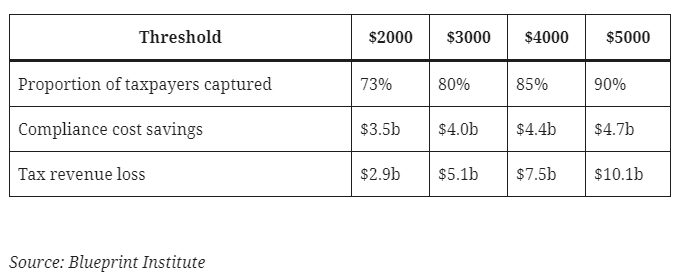

For the vast majority of taxpayers – around 80 per cent, according to Blueprint’s modelling – the standard deduction would leave them better off.

For the average taxpayer, that benefit is estimated at $400-600, which is effectively a tax cut.

For the remaining 20 per cent who have unusually large work-related expenses nothing would change. They (or their accountant) would fill in their claims on a tax return.

What would change, according to Blueprint’s report, is that 7-8 million taxpayers would no longer need to fill in a tax return, saving them time and, in many cases, money.

“Australians spend $2.3 billion a year managing their tax affairs,” the report noted.

“And, because it’s tax deductible, a big chunk is picked up by the taxpayer.

“Seventy per cent of people pay an accountant to prepare their tax return – an unusually high proportion across the world.

“The ATO costs us $3.8 billion a year to administer and enforce the tax law, employing nearly 20,000 people.

“That means one in every $300 in our economy goes to the ATO or a personal tax accountant or lawyer – two sides of the same coin.”

Mr Hamilton said that meant there was at least $4 billion in compliance costs to be saved through a standard deduction.

Plus the effective tax cut would provide economic stimulus equivalent to 0.5 per cent of the size of the economy, at a time when the economy is still emerging from its COVID recession.

“Nobody loses, everybody wins,” he argued.

Standard tax deduction not a new concept

Not quite. If that were the case, there’s no doubt we’d already have a standard deduction.

An obvious group of losers are the accountants who specialise in large volumes of small-scale individual tax returns, be they the bigger firms or the small high street operations.

The government would also lose, at least up front.

Blueprint estimates a standard deduction pitched at $3000 would cost the budget just shy of $5 billion a year in lost revenue.

In fact, a standard deduction has been proposed before.

It was recommended by the Henry Tax Review and picked up by then-treasurer Wayne Swan in his 2010 Budget.

The plan was to offer the option of a $500 standard deduction for workplace expenses in 2012-13, increasing to $1000 the following year.

“This means less time with the Tax Pack, more time with loved ones, and for 6.4 million Australians it also means a bigger tax refund,” Mr Swan said in his budget speech.

Except it never happened.

Even the more modest $608 million estimated cost of that smaller deduction proved too great at a time when the government was desperately trying to cut the deficit and return to a promised surplus.

Why $3000?

So why has Blueprint gone for the much bigger deduction of $3000, given that the smaller proposal never made it off the ground, especially when the majority of work-related deduction claims total less than $674?

Steven Hamilton pointed to modelling by Blueprint that showed $3000 was “the right answer in terms of efficiency”.

Aside from the extra tax deduction that most taxpayers would receive, Blueprint argues that the current system is open to “gaming” by those who know how to work the deductions system and those who are less scrupulous about what is and what isn’t a work-related expense.

“Two people in otherwise similar circumstances pay very different amounts of tax, in this case because one of them knows how to exploit the system,” the report observed.

“This should receive far more attention in public discussions around fairness.

“It undermines the integrity of the tax base, and the faith of the citizenry in its government.”

Mr Hamilton also pointed out that higher income earners tended to be better at playing this game, often with better coaches on their side in the form of top accountants and tax lawyers.

“The current deduction system is modestly regressive,” he said, adding that the standard deduction would go some way to correcting the balance by favouring lower income earners who tended to have fewer deductions.

Tighter rules for what is ‘work-related’

While not modelled and costed as part of its proposal, Blueprint’s report also suggests tightening the rules for those who choose to keep claiming work-related expense deductions above the $3000 standard.

The tax law currently states that: “You can deduct from your assessable income any loss or outgoing to the extent that it is incurred in gaining or producing your assessable income.”

Blueprint is arguing that should be changed to: “You can deduct from your assessable income an expense that is necessary to fulfil the requirements of your employment, and is wholly and exclusively incurred in gaining assessable income.”

Unlike the standard deduction, that proposal certainly would create some very powerful losers who might lose the ability to claim large travel, technology or vehicle purchase costs, just to name a few common big ticket deductions.

© 2020 Australian Broadcasting Corporation. All rights reserved.

© 2020 Australian Broadcasting Corporation. All rights reserved.

ABC Content Disclaimer