Six graphs that explain Australia’s recession

Peter Martin, Crawford School of Public Policy, Australian National University

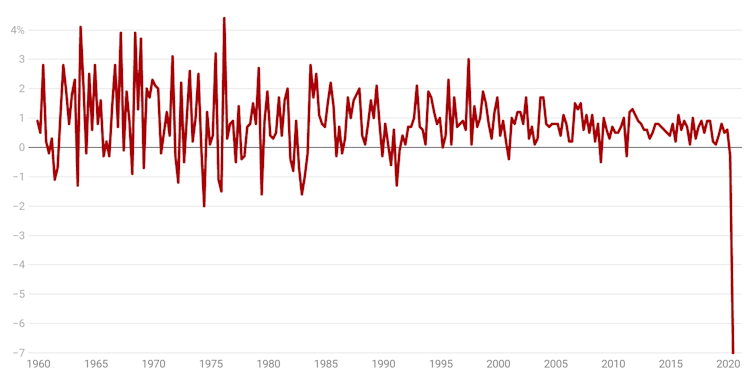

Australia’s recession is the deepest since the Great Depression of the early 1930s.

Nothing else comes close.

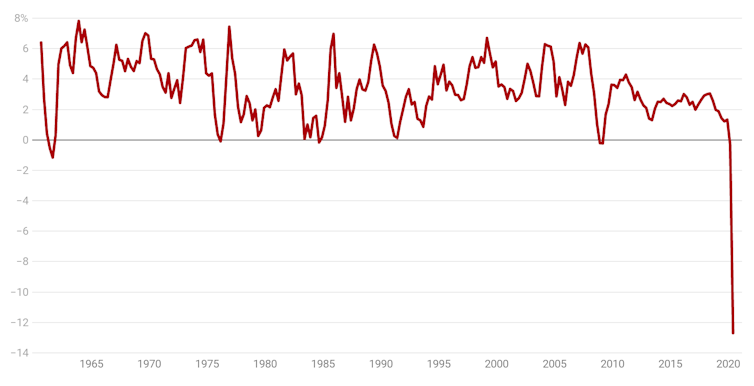

The economy shrank an extraordinary 7 per cent in the three months to June – by far the biggest collapse since the Bureau of Statistics began compiling records in 1959.

The previous worst quarterly outcome was minus 2 per cent, in June 1974.

Quarterly percentage change in gross domestic product

It was going to be worse.

Treasurer Josh Frydenberg told a parliament house press conference that in March his advisers were predicting a collapse three times as big in the June quarter – 20 per cent. In May, the forecast was for a June quarter collapse of 10 per cent.

Britain’s economy actually did collapse 20 per cent in the June quarter; the US economy collapsed by nearly 10 per cent.

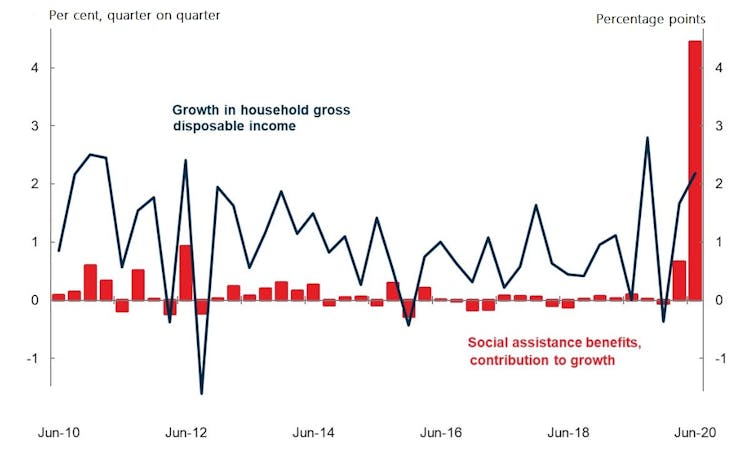

What staved off a collapse of the order feared was unprecedented government support – more than $100 billion in JobKeeper and expanded JobSeeker payments alone – enough to actually lift household incomes while 643,000 Australians lost their jobs and many more lost hours.

Contribution of government benefits to household income growth

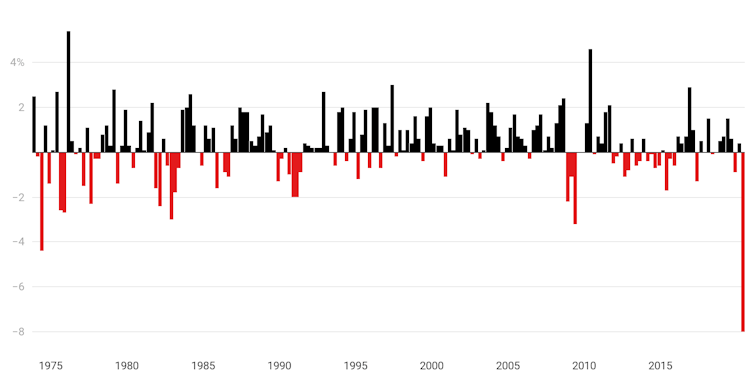

A better measure of living standards, taking into account households and businesses, so-called “real net national disposable income per capita”, fell nonetheless, by a record 8 per cent.

Quarterly percentage change in living standards

Quarterly change in real national disposable income per capita. ABS Australian National Accounts

Quarterly change in real national disposable income per capita. ABS Australian National Accounts

Consumer spending fell by even more, an extraordinary 12.7 per cent, in part because lockdowns and caution in the face of COVID-19 provided fewer opportunities to spend.

Given that consumer spending climbed not at all over the three quarters leading up to the June quarter, it meant that household spending fell over the entire financial year, for the first time since records have been kept.

Quarterly change in household final consumption expenditure

ABS Australian National Accounts

ABS Australian National Accounts

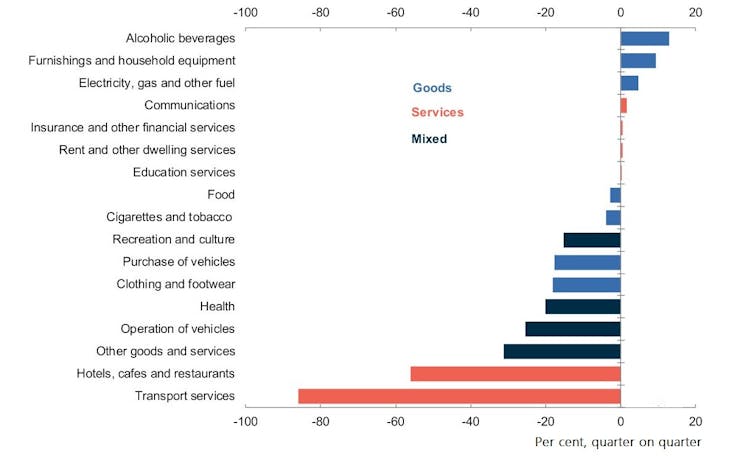

Spending on goods was barely hit, while spending on services collapsed 17.6 per cent.

Spending on transport services, a category that encompasses everything from flights to public transport, fell 88 per cent. Spending on accommodation, a category that encompasses tourism, fell 55.7 per cent.

Spending on recreational and cultural services, a category that encompasses sporting events, gambling and performances and cinema admissions, fell 54.5 per cent.

Household spending by category

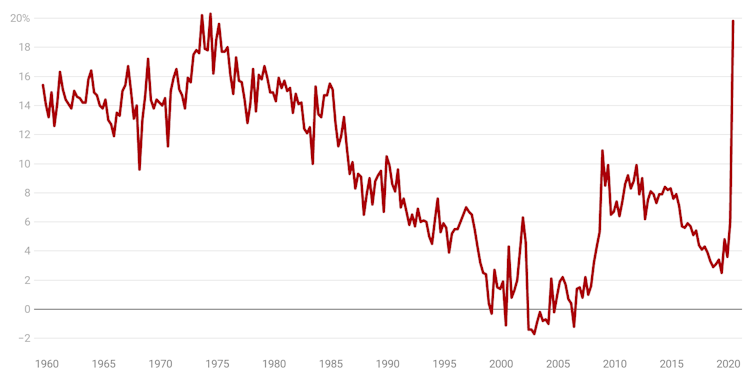

It meant far more income than usual was saved. During the depths of the global financial crisis, Australia’s household saving ratio climbed to a peak of 10.9 per cent as households squirrelled away one in every 10 dollars they earned.

In June, they squirrelled away a remarkable 19.7 per cent – one in five dollars that came in the door.

Household saving ratio

ABS Australian National Accounts

ABS Australian National Accounts

The Bureau of Statistics says if household income from special initiatives including early access to super was included, the household income ratio would be even higher. What it calls the “household experience savings ratio” would be 24.8 per cent.

It’s possible to see households saving one in every four dollars as a ‘glass half full’. Mr Frydenberg does.

He says this never-before-experienced accumulation of savings will be useful in the recovery, giving people the capacity to spend big when restrictions ease and they are better able to spend.

What if we remain unwilling to spend…

That’s assuming people aren’t ‘scarred’ by the experience, left with damaged psyches and unwilling spend, a possibility the Treasurer acknowledges.

He says for the next quarter, the current one that encompasses the three months to the end of September, the Treasury is expecting economic activity to shrink only a little further or no further at all.

A lot depends on how soon Victoria’s stage four restrictions and other restrictions are eased, which means a lot depends on things that are unknowable.

… and businesses unwilling to invest?

The Treasurer will deliver the budget in a little over four weeks’ time.

He said a key part of it will be measures to make it easier for businesses to do business, unlocking “entrepreneurship and innovation” at low cost.

Businesses certainly could invest more. Non-mining business investment was down 9.3 per cent in the quarter. On Tuesday, the Reserve Bank made available an extra $57 billion at low cost for banks to advance businesses and households.

But they are only likely to want to invest more when they can see returns.

Read more: When it comes to economic reform, the old days really were better. We checked

Examining the figures on Wednesday, former Reserve Bank economist Callam Pickering said they showed the economy being held together “with duct tape by JobKeeper and JobSeeker”.

At his press conference, Mr Frydenberg resisted suggestions that he revisit the wind-downs of JobKeeper and the JobSeeker Coronavirus Supplement due to take place over the next six months.

But the Victorian situation is far worse than when he announced the schedule on 21 July.

He might find there’s a case for more duct tape, for a while longer.![]()

Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

This article is republished from The Conversation under a Creative Commons licence. Read the original article.

Have you been ‘squirrelling’ away extra savings? Have you cut back your spending? Or has it been spending as usual?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/retirement/news/retirement-income-system-fails-this-group

https://www.yourlifechoices.com.au/health/news/can-ageing-be-treated-or-cured

https://www.yourlifechoices.com.au/food-recipes/news/how-healthy-is-your-supermarket