How many Australians do you think would turn their backs on annual savings of up to $1500?

You may have answered none, but new research puts that figure at almost one in four.

Research from online comparison site Mozo reveals that as many as 21 per cent of Australians with home and contents insurance never review their policies, blindly renewing them every year.

The figure is perhaps not surprising. After all, most of us are far too busy – or too lazy? – to review our insurance premiums annually.

But savings in the vicinity of $1551 a year could make a big difference to household budgets, especially given rising interest rates and inflation.

Read: Will climate change increase our home insurance?

Mozo’s research team surveyed 1775 Australians between August and September and found $1550 was the average amount policyholders could save by comparing home and contents insurance policies when renewing and switching to a more competitive provider.

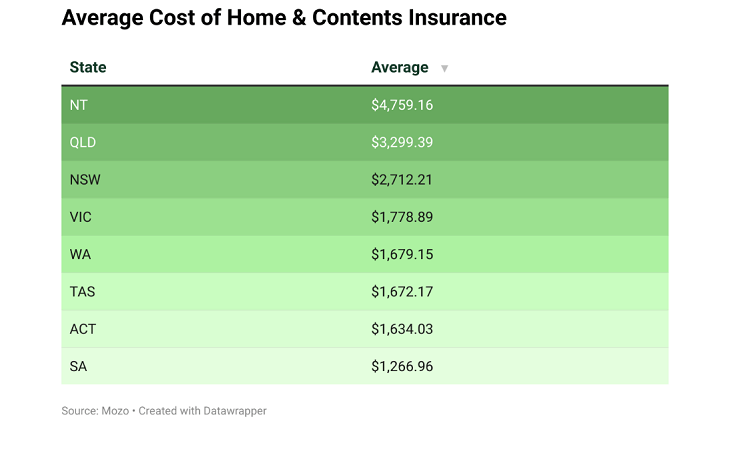

The team also calculated the average cost of home and content insurance across the states and territories in the panel below and found that the Northern Territory ($4759) followed by Queensland ($3299) had the most expensive policies.

Mozo personal finance and insurance expert Claire Frawley says: “There are not many people around at the moment who wouldn’t want an extra $1500 in the household kitty.”

One of the big mistakes many make, Mozo says, is revisiting and reviewing home and contents insurance only when we move. But circumstances can change in other ways without a move.

For example, some older Australians might become empty nesters, with the value of the household contents falling as the kids move out. Or renovations may have been done. Of course, the latter could result in an increase in your premium, but it will also ensure you aren’t left underinsured.

What about other types of insurance?

While Mozo’s research focuses on house insurance, the same could well apply to other forms of insurance. Take car insurance, for example. Each year when I get a renewal notice for my car insurance, I make sure to note that the increase is not prohibitive and then more or less forget about it, as my premiums come out of my bank account via direct debit.

Read: How to get the best deal on your car insurance

However, I have now had the same car for more than a decade and its value is certainly nowhere near what it was when I bought it. And yet, looking at the comprehensive insurance I’m paying, the amount rises each year.

The rise is only small, and the easiest option is to ignore it. The cynical among us might suggest that’s exactly what our insurers hope we will do. They may also be relying on our loyalty. But, as Ms Frawley points out: “When it comes to home insurance, loyalty doesn’t always pay off. Before renewing your policy, it’s important to review and compare how much you are paying.”

And with a bit of negotiation, you might even be able to transfer your ‘loyalty’ benefits to your new insurer. “If you do find you are overpaying and choose to switch providers, often you can negotiate for any no-claim bonus to be transferred across to your new policy,” says Ms Frawley.

Read: Tips to make sure your home insurance claims will be paid

It’s worth at least considering your options in the current financial climate. With more Australians feeling the pinch, spending an hour or two comparing and switching where applicable could make a significant, positive difference.

Consumer advocate CHOICE offers a comprehensive wrap to help you find the right policy and warns that your location will have a big bearing on what you need to pay.

CHOICE says: “When we compare home and contents insurance, we collect quotes for addresses around the country, using a range of scenarios from an expensive ‘McMansion’ to an old weatherboard house.

“When we compared home insurance in 2020, the quotes we collected ranged from around $1300 in suburban Perth to more than $25,000 in cyclone-prone North Queensland.”

CHOICE stresses that it pays to shop around, adding: “For one property, the range in quotes was nearly $18,000. In the best case, the most expensive quote was double the least expensive.”

CHOICE offers the following tips to get the lowest premium:

- Shop around. Get quotes from three insurers – some will match or beat competitors’ premiums.

- Vary your excess. Small increases in the excess can lead to big savings on premiums.

- New customers often get cheaper premiums than renewing customers. Simply checking your renewal price against your current insurer’s online quote calculator could save you plenty.

- Consider multiple policies with one insurer to get a bigger discount. If you can get the cover you need by combining insurance, it’s a useful way to save. However, make sure all their policies suit your needs – you don’t want to get discounted home and contents cover just to end up with a dud car insurance policy.

How often do you review your home insurance premiums? Have you made a saving by switching insurers? Why not share your experience in the comments section below?

I live in Far North Queensland. I dropped my home and contents insurance eight years ago when the premiums became unaffordable. Best move I ever made as I have saved the $20,000 or more that I would have paid in premiums and can use that for any repairs if any are ever required.

Also I’d like to comment on these ratings agencies. The companies they give their highest ratings to will not insure people where I live so their ratings are dishonest because they don’t compare like with like. Any company that will not insure people in high risk areas is always going to carry lower risk so will be able to offer lower premiums to customers in areas where it does offer cover so unfairly receives a higher rating.

I dont know where you get these figures from but I pay less than $700.00PA and just finished a claim for storm damage to a garage door . I paid $750.00 excess and the bill was $4,000 .

I have gone on line and seen these ridiculous amounts for home and contents insurance and its the same with my car insurance at around $600.00 so, I don’t know how these companies rip people off to this degree .I think sometimes people include the cost of the block of land which the house is built on and can add $400,000 easily to your quote.Same with the car people over value what their vehicle is worth. Take a bigger excess you will save money in the long run because the truth is in all my years I have made one household claim and three claims for car insurance over 50 years.

After a massive hailstorm and needing our whole, very large, metal roof replaced at a high cost we are more than happy to stay with our current insurer.

There was also a claim at each of our previous homes and there never was any dispute or problem in having repairs effected, to our satisfaction.