We are all used to private health insurance rebates on 1 April every year, but this year the rebates will be going down on the same date, a rare occurrence. Here how the rebate system works.

The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums.

The rebate is income tested, which means your eligibility to receive it depends on your income for surcharge purposes. If you have a higher income, your rebate entitlement may be reduced, or you may not be entitled to any rebate at all.

To be eligible for the private health insurance rebate, your income for surcharge purposes must be less than the tier three income threshold. Tier three is the highest income threshold for both singles and families.

Income for surcharge purposes includes:

- your taxable income

- your reportable fringe benefits (as reported on your income statement or payment summary)

- your total net investment losses (including both net financial investment losses and net rental property losses)

- your reportable super contributions (which is the sum of your reportable employer superannuation contributions and your deductible personal superannuation contributions).

The rebate can be claimed for premiums paid for a private health insurance policy that provides private patient hospital cover, general cover (commonly known as extras), or combined hospital and general cover. The government does not give this rebate on the lifetime health cover loading component of a policy.

You can claim the private health insurance rebate as a reduction in the amount of private health insurance premiums you pay to your insurer. Alternatively, the Australian Taxation Office (ATO) will calculate your private health insurance rebate when you lodge your tax return. This rebate is a refundable tax offset.

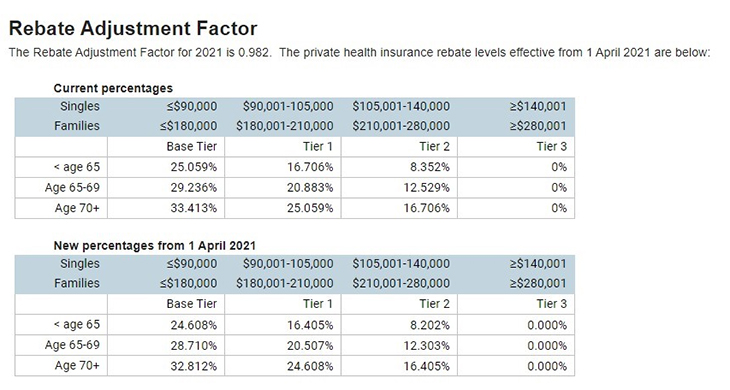

The rebate percentage is adjusted on 1 April each year and this year the private health insurance rebates are going down (see table below).

How rebate adjustment works

All private health insurance rebate percentages are adjusted annually on 1 April by a ‘rebate adjustment factor’.

The rebate adjustment factor is a percentage of the increase in the consumer price index (CPI) and the average annual premium price increase. It is calculated by the Department of Health.

You don’t need to do anything as a result of a change in rebate percentages.

If you claim your rebate as a premium reduction, your health insurer will adjust your rebate percentage and the rebate amount.

If you claim your rebate as a tax offset in your income tax return, the ATO will apply the adjusted rebate percentages to determine your correct private health insurance tax offset.

You don’t need to contact your health insurer to change your rebate percentage from 1 April.

However, you can choose to contact your insurer, for example, to nominate a new rebate amount if you think your income will result in you being entitled to a lesser rebate when you lodge your tax return.

Are you worried about the effect of health insurance increases this year? Will you be able to afford it?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/five-smart-moves-for-empty-nesters

https://www.yourlifechoices.com.au/finance/insurance/ex-smoker-you-could-be-missing-out-on-cheaper-life-insurance

https://www.yourlifechoices.com.au/finance/choice-tips-to-take-charge-of-2021