AustralianSuper heads a list of 15 Aussie superannuation funds to make the top 300 in the annual pension and investments rankings released by the Think Ahead Institute.

The institute, a not-for-profit research group funded by British-American multinational insurance adviser Wilson Tower Watson, has been publishing pension ranking surveys since 2015. Its 2022 edition paints a positive picture of our super sector.

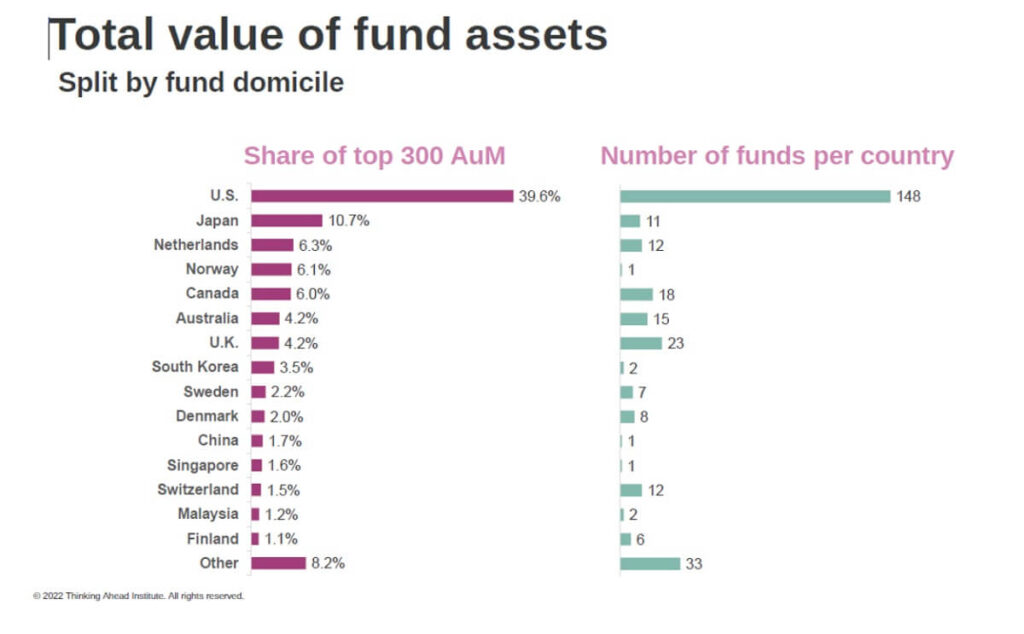

Although Australia’s share of the top 300 global pension funds weighs in at only 4.2 per cent, it beats countries such as the UK and South Korea, which have significantly larger populations.

With $US169.1 billion in assets, AustralianSuper heads the 15 funds from ‘down under’. Coming in next, at 26th on the overall list, is Future Fund, with total assets of $US147.9 billion.

Read: Funds accused of gaming super performance test

Other Australian funds to make the top 300 include Aware Super (46th overall), QSuper (54th) and UniSuper (77th).

The global report observes that: “Australia is witnessing a notable consolidation of superannuation funds.”

The report does not speculate as to the reasons behind that consolidation, but one driver may be the Your Future, Your Super performance test.

As reported by YourLifeChoices last September, BT’s MySuper fund, by far the largest of the failing funds with $21.1 billion in assets, has announced an intention to merge with Mercer Super.

Read: Australians expect superannuation shortfall

While Australia’s overall standing in the funds under management (FUM) table appears impressive, there are a number of contributing factors that skew it in its favour. The biggest of those is that most Australian funds are defined contribution – rather than defined benefit – funds.

As the name suggests, a defined benefit fund is determined by a formula instead of being based on investment return. To cater for this, defined benefit funds must have significant sums invested in bonds to ensure they have cash on hand to pay for members’ retirement needs.

Most Australian funds have moved away from this model to a defined contribution one, leaving Australia with a comparatively higher FUM figure than countries that favour the defined benefits model.

Read: How early should we sell investments to claim the Age Pension?

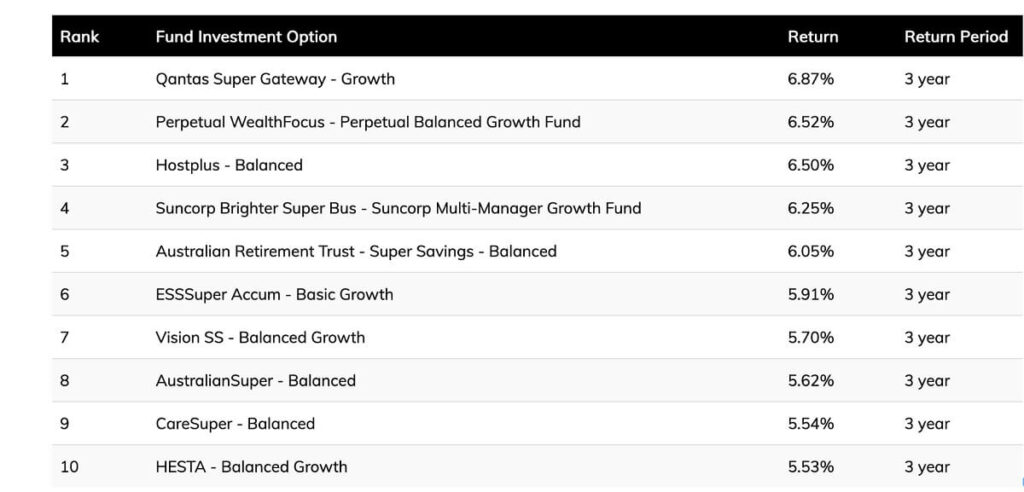

Although the Think Ahead Institute report provides a reasonable indicator of the health of a super fund, it does not tell the full story. A glance at the top 10 performing funds over the past three years, as reported by SuperRatings, provides contrasting ranks for funds when measured by returns.

The table confirms AustralianSuper’s Balanced fund as ranking eighth, with Hostplus, ranked 127th on the FUM table – well behind AustralianSuper, coming in third. And at the top of the table is Qantas Super Gateway Growth fund, despite not having enough funds under management to make the Think Ahead Institute’s top 300.

The institute’s full report, which provides summaries of pension fund distribution using various different measurements, is available via the Think Ahead website.

How do you assess the performance of your super fund over the past year? Are you confident of better returns in 2023? Why not share your thoughts in the comments section below?