The potential scrapping of the legislated superannuation guarantee rise from 9.5 per cent to 12 per cent by 2025 would come at a significant cost to taxpayers, according to new modelling.

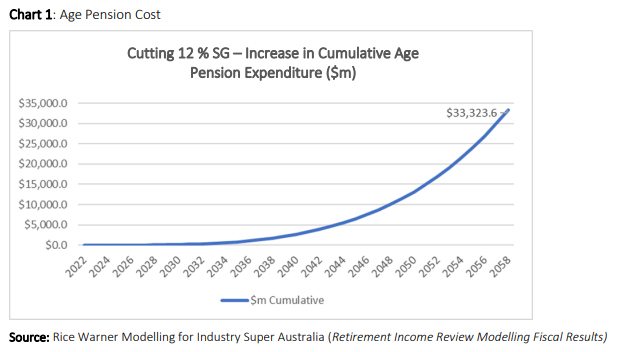

Actuarial firm Rice Warner has run the numbers on what the effects of not proceeding with the planned superannuation increases would mean, and the impact on taxpayers would be huge, with Age Pension costs predicted to balloon by $33 billion over coming decades.

According to the modelling, each year that people retire without the benefit of the legislated superannuation boost, pension costs will climb by billions.

Australia’s ageing population means there are fewer taxpayers for every pensioner, making it likely future government would need to raise taxes to meet this bulging pension burden, according to Industry Super Australia chief executive Matthew Linden.

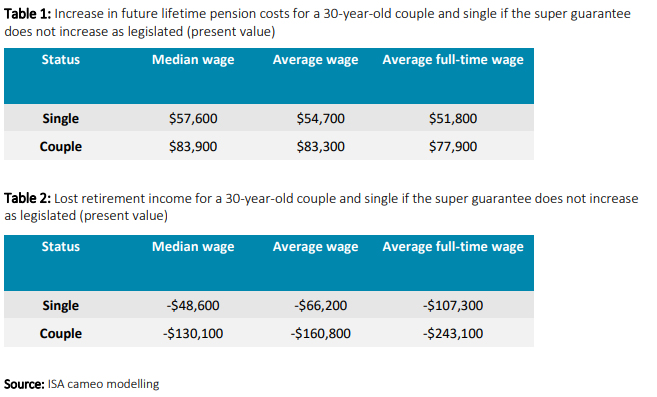

He explained that despite the increased pension costs, workers would still be worse off.

Mr Linden said that figures from the government’s Retirement Income Review reveal that ditching the increase would leave all income groups with lower lifetime disposable incomes.

“Dumping the legislated increase in the SG [superannuation guarantee] will unequivocally leave Australians with less private savings at retirement and more reliant on the publicly funded age pension,” Mr Linden said.

“There is no free lunch; for every dollar taken out of super early the taxpayer has to pay back even more in higher pension costs – that’s why if the government opts out of super it opts in to higher taxes.

“This short-sighted policy will leave workers tens of thousands worse off and a huge pension bill that we will have to pay through higher taxes.”

In other superannuation news, the Association of Superannuation Funds of Australia (ASFA) has called for changes to increase fairness in the system in its pre-budget submission to the government.

ASFA chief executive Dr Martin Fahy said the system needed reform to protect lower income earners, including lowering the superannuation taxes for people earning between $37,000 and $45,000, and higher super taxes for higher income earners.

“Superannuation is about ensuring people have adequate income in retirement, it is not about facilitating excessive wealth transfers,” Dr Fahy explained.

According to the association, recent changes in tax rates have created an unintended distortion where low-income earners between $37,000 and $45,000 pay a similar tax rate on superannuation contributions to the marginal tax they pay on wages.

Dr Fahy believes that the low-income superannuation tax offset should apply to individuals with taxable income of up to $45,000.

As that change would have an impact on government revenue, Dr Fahy believes that the shortfall should be made up through a modest reduction in the Division 293 threshold from $250,000, that is the level at which super contributions are taxed at 30 per cent rather than 15 per cent.

It also suggests removing indexation of the transfer balance cap and removing balances above $5 million from the concessionally taxed superannuation system.

Do you support the legislated increase to the superannuation guarantee? Do you think the government will axe the increase in coming months?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/call-to-tax-retirees-super-income

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/that-extra-youre-about-to-get-in-super-most-of-it-will-come-from-you

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/superannuation-mistake-that-could-cost-you