One year ago, the prospect of superannuation funds recording double-digit returns seemed inconceivable, but that it exactly where a lot of funds are headed, according to analysis from a leading superannuation research house.

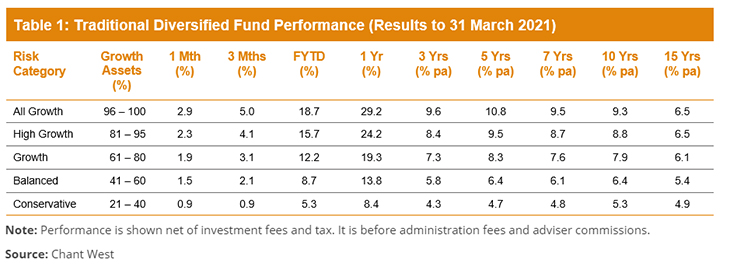

Chant West figures released this week show that super funds have continued their astonishing COVID rebound, with the median growth fund (with 61 to 80 per cent in growth assets) up 1.9 per cent for the month of March and 3.1 per cent for the quarter.

That brings the return for the first nine months of the financial year to an impressive 12.2 per cent and with the share markets continuing to head in the right direction in April, there is a strong chance that growth funds will finish the year in double-digit territory.

Read more: Super fund recovery steps up pace

Chant West researcher Mano Mohankumar said that the strong performance of the share market was one of the main drivers of the growth fund performance in the March quarter.

“Despite the brief volatility in late February on fears that a stronger than expected economic recovery may result in increased inflation, the March quarter was characterised by optimism around the global rollout of vaccines and a return to some economic normality,” Mr Mohankumar said.

“Australian shares were up 4.2 per cent for the quarter, while international shares were up 6.2 per cent and 6.3 per cent in hedged and unhedged terms, respectively.

“Bond yields rose over the period – again as a reaction to fears of rising inflation – and this was reflected in negative bond market returns with Australian and international bonds down 3.2 per cent and 2.5 per cent, respectively.”

Read more: Best performing super funds of the past 10 years

He also explained that the signs were looking good for further growth next month and pointed to international vaccine progress as a positive sign for global markets.

“Share markets are up again over the first half of April, and we estimate that the median growth fund has put on a further 2.2 per cent so far this month.

“That brings the cumulative return since the end of March last year to about 22 per cent, which is remarkable given the health concerns, disruptions and economic damage caused by COVID-19.

“It also means that we are more than 7 per cent above the pre-COVID crisis high that was reached at the end of January 2020.

Read more: Super funds fight for changes to reforms

“In the US, vaccine rollouts gained momentum over the quarter and the number of new COVID-19 cases fell.

“The UK is also progressing well with its vaccine rollout and we’ve seen some easing of lockdown measures over the past month. In the eurozone, however, the pace of vaccinations has lagged other developed regions and some countries experienced increases in new COVID-19 [infections], resulting in fresh lockdown measures.”

Long-term performance

Chant West explains that since the introduction of compulsory super in 1992, the median growth fund has returned 8 per cent per annum.

The annual CPI increase over the same period is 2.4 per cent, giving a real return of 5.6 per cent per annum – well above the typical 3.5 per cent target.

Even looking at the past 20 years, which now includes three share major market downturns – the ‘tech wreck’ in 2001-2003, the GFC in 2007-2009 and now COVID-19 – the median growth fund has returned 6.8 per cent per annum, which is still well ahead of the typical return objective.

Is your super fund on track for double digit growth this financial year? Are you surprised at how quickly super has rebounded this year?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.