We all know that where you live can have a big impact on how comfortable you are in retirement, but did you know that it could also have an effect on your retirement savings?

New research from Industry Super Australia reveals that Northern Territory residents have the lowest superannuation savings in Australia.

Meanwhile, those in the Australian Capital Territory, where the workforce is heavily skewed towards public servants, have the highest super savings in the country, well above the Australian mean figure.

Read more: Call to make super assets clearer

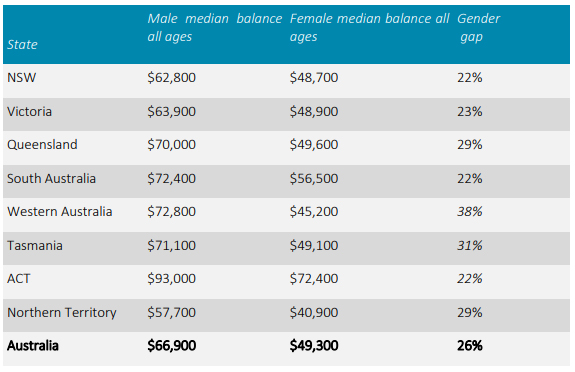

The median super balance for a man in the Northern Territory across all ages is $57,700, which is considerably lower than the Australian average of $66,900.

The mean super for women in the Northern Territory across all ages is the lowest in the country at $40,900, nearly $9000 less than the Australian average of $49,300.

Superannuation balances in the ACT average $93,000 for men and $72,400 for women, comfortably the best result across Australia.

When it came to men’s super balances aside from the Northern Territory, the only other states under the Australian average were NSW and Victoria.

Women, however, were under the Australian average in NSW, Victoria, Western Australia, Tasmania and the Northern Territory, with only Queensland, WA and the ACT performing above the average.

Western Australia led the way as the state with the biggest gender pay gap, with the median super balance of $72,800 (the second highest in the country) dwarfing the female average of $45,200 (the second lowest in the country) by 38 per cent.

Read more: Biggest retirement rip-offs

The gender pay gap was at its lowest in NSW, South Australia and the ACT (all 22 per cent) and Victoria (23 per cent).

Industry Super Australia director of advocacy Georgia Brumby said the figures highlighted the need to lift the super rate to 12 per cent as per the legislation currently in place.

“It is not right that Territorians continue to retire with super balances persistently lower than what they need for an adequate retirement,” she said.

Ms Brumby accused superannuation minister Jane Hume of abdicating her responsibility when it came to addressing the gender pay gap and called for Northern Territory MPs Luke Gosling and Warren Snowden to push the Coalition to do more.

“NT MPs have a choice – they can fight for a super increase and get super paid on every dollar earnt or turn their back as a generation of NT women risk retiring into poverty,” Ms Brumby said.

“There is little more important to a woman’s economic security than super.

“Jane Hume, as both the super minister and the minister for women’s economic security, has an opportunity in Tuesday’s Budget to show real leadership and boost the savings of women.”

How do your superannuation savings compare to the Australian average? Are you doing better or worse than average? Do you support the legislated increase to the superannuation guarantee reaching 12 per cent? Do you think the government will announce that it is sticking with this plan in Tuesday’s Budget?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.