As YourLifeChoices has reported throughout the year, 2021 has been a year of almost unprecedented super growth, but many of those who have not been paying attention to where their money is invested have missed out.

Worse still is the fact that retirees are the ones most likely to have missed out on those good times, particularly those with conservative investment options.

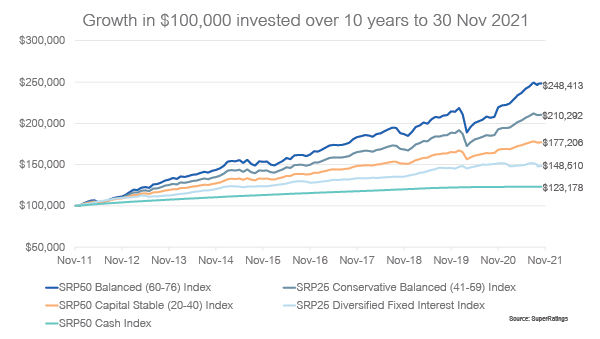

Analysis by investment research house SuperRatings, which tracked the returns of the most common super fund options over the past 10 years, showed incredible disparity between some of the investment choices, highlighting the need to pay attention to the way your super fund is invested.

Read: Super funds with responsible investment increasingly profitable

The graph below highlights the huge difference between superannuation funds invested in a balanced option compared to those invested in a fixed interest index.

SuperRatings executive director Kirby Rappell explained that if a person invested $100,000 in a typical balanced option, that money would have increased 148 per cent over the 10 years, to be worth $248,413.

In contrast, a member with the same amount of money invested in a cash option would only have increased by 23 per cent to have $123,178.

Read: Retirees should splash on themselves and save the economy

The shortfall between the two options of over $125,000 highlighted the challenges for those with significant exposure to cash investments.

“While the balances of younger members grow strongly, those members trying to derive an income from their savings face some very real difficulties,” Mr Rappell said.

The SuperRatings analysis shows that the majority of pension assets sit in balanced, conservative balanced and capital stable options, with the latter two investments investing more in bonds and cash-like investments.

Read: Government warns super funds about charging new fees

An investment of $100,000 would have grown to $210,292 in the median conservative balanced option over the past decade, while growth was more muted for capital stable members and those invested mainly in bonds through the typical diversified fixed interest option.

The graph also shows that there was a dip in balances due to the pandemic, with older members in more conservative options less impacted than growth focused accumulation members, but that loss was quickly recovered this year.

Looking at cash options more closely, over the past 10 years, a member sitting in cash would have seen a return of only 2.2 per cent per annum.

“The experience of many Australians with exposure to cash has been extremely challenging,” Mr Rappell said. “Reviewing your risk profile remains important, as retirees need to ensure they are invested in a way that helps them achieve their long-term objectives.

“We also need to see greater innovation in this space to ensure that super funds are able to help retirees achieve appropriate outcomes in retirement.”

November superannuation performance

According to SuperRatings’ data, November was another positive month for superannuation as confidence remained high as the economy opened up further.

The median balanced, growth and capital stable options all rose an estimated 0.3 per cent in November, with the balanced option returning an estimated 11.4 per cent for the calendar year to date and the growth option returning an estimated 14.1 per cent over the same period.

Pension returns were also positive in November.

The median balanced pension option returned an estimated 0.3 per cent over the month and 12.0 per cent over the calendar year to date.

The median pension growth option also returned an estimated 0.3 per cent and the median capital stable option gained an estimated 0.4 per cent through the month.

How much of your superannuation or pension fund money is invested in cash options? Would you consider changing to investing more in balanced options, looking at these results? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.