There is no doubt that the past financial year was a massive one for super funds, although there is some debate about exactly how long it has been since we have seen a year with such impressive results.

As we reported earlier this month, the Association of Superannuation Funds of Australia’s (ASFA) chief executive, Martin Fahy, said super results were the strongest performance in nearly 30 years. Research houses Chant West and Rainmaker Information provided their own assessment with the former claiming it was the best result in 24 years and the latter claiming it as the best of the past 34 years.

Regardless of who you choose to believe, the way superannuation recovered from the depths of the COVID disaster last year has been unmistakable and is perhaps best reflected by the fact that even the worst performing fund in the growth category returned a respectable 13 per cent last year.

Read more: What to check when you get your super statement

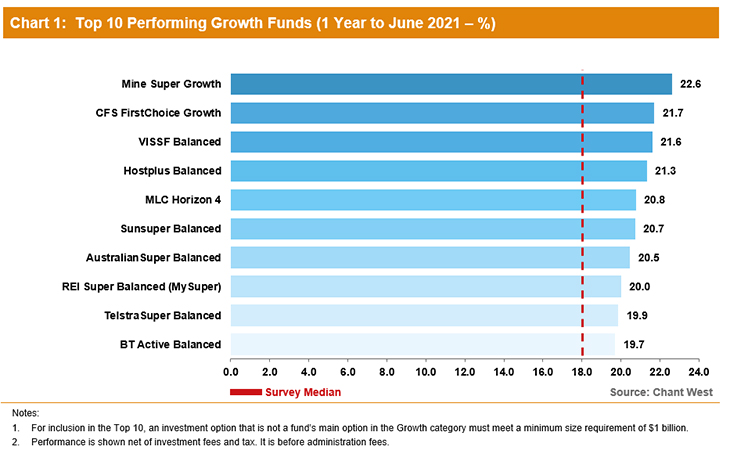

Chant West, which looked solely at the performance of growth funds, which is why its ratings of the year’s performance differed from ASFA and Rainmaker, also compiled a list of the top 10 performing funds for the year.

With your superannuation statement set to arrive in the mail soon, you might be impressed with the returns your fund achieved, but it is important to check the performance against what other funds achieved over the same period.

Eight of the top 10 funds returned 20 per cent over the course of the year, led by Mine Super Growth (22.6 per cent) ahead of CFS FirstChoice Growth (21.7), VISSF Balanced (21.6), Hostplus Balanced (21.3) and MLC Horizon 4 (20.8).

Chant West research manager Mano Mohankumar said the results showed the importance of patience during a market downturn, such as that experienced as a result of the pandemic.

Read more: Super funds have 50-50 chance of passing performance test

“An 18 per cent return would have been inconceivable a year ago and represents a welcome reward for fund members who held their nerve and remained patient through the depths of the COVID-induced market crisis,” Mr Mohankumar said.

“The experience over the past two years highlights the resilience and robustness of super funds’ portfolios.

“Despite the battering that share markets took over February and March 2020, the diversification built into growth funds enabled them to limit the damage to a small loss of 0.6 per cent for FY20, which was a much better result than expected. And in FY21, with over 50 per cent allocated to listed shares, these funds were able to capture a meaningful proportion of the upside as markets staged a strong and sustained rally.

“In fact, growth funds finished FY21 more than 10 per cent above the pre-COVID crisis high that was reached at the end of January 2020.”

Read more: Super changes could put future performance at risk

According to Mr Mohankumar, the funds that performed the best in the past year were those with higher allocations of listed shares, particularly international shares.

This was due to the fact that Australian shares gained 28.5 per cent over the past year and international shares jumped 37.1 per cent.

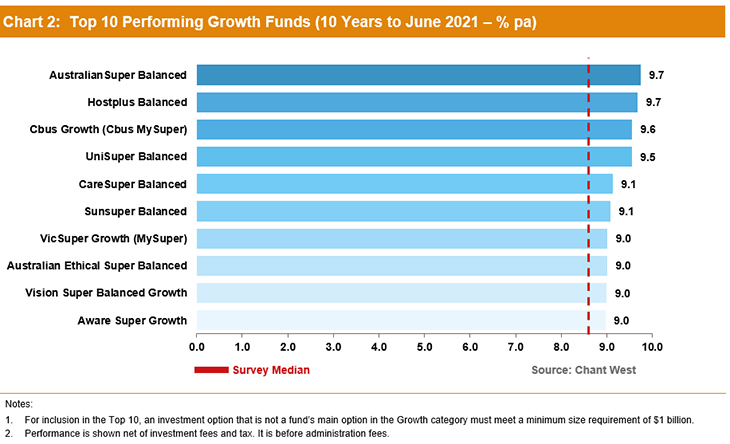

Chant West also updated its figures to compile a list of the top 10 performing growth funds over the past 10 years, with all of these funds returning 9 per cent or more per annum.

AustralianSuper Balanced and Hostplus Balanced were equal first (9.7 per cent per annum) ahead of Cbus Growth (9.6), UniSuper Balanced (9.5), CareSuper Balanced (9.1) and Sunsuper Balanced (9.1).

Mr Mohankumar said it was more important to judge long-term performance of a fund as the high returns of the past year were unlikely to continue.

“Super funds have had a tremendous year, with a median return of 18 per cent but returns at that level shouldn’t be thought of as normal,” he said.

“The typical long-term return objective for growth funds is to beat inflation by 3.5 per cent p.a., which translates to about 5.5 per cent to 6 per cent p.a.”

Alex Dunnin, executive director of research at Rainmaker Information, said the only time that super returns have performed better than they did last year was just prior to the 1987 stock market crash.

Returns in the 1986-87 financial year peaked at 19 per cent, which was just above the 18 per cent recorded in the Rainmaker Default MySuper Index for 2020-21.

“These returns mean Australia’s 13.5 million super fund members earned $520 billion in investment earnings in the past 12 months, or almost $39,000 each,” Mr Dunnin said.

Have you got your super statement yet? How did you fund perform last year? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.