Henry Cutler, Macquarie University

Paying for residential aged care accommodation in Australia is complex.

Residents can pay a lump sum known as a refundable accommodation deposit (RAD), a rental style payment known as a daily combination payment (DAP), or a combination of both.

Deciding between the two is an important, complex financial decision influenced by a host of factors. And the stakes are high; it’s common to sell the family home to pay for aged care accommodation. Making the wrong accommodation payment decision could lead to reduced income and wealth, paying more for care, and having less to leave in bequests when you pass away.

Many residents get help from loved ones to navigate their way into residential aged care because they are experiencing age-related cognitive decline. So how do people make this decision and what role does financial literacy play?

To find out, we measured the financial literacy of 589 informal carers who substantially helped a resident decide their plan.

Our study found fewer than half of all respondents were financially literate. Many were underconfident in their financial literacy. Others were overconfident, potentially leading to payment decision mistakes.

Shutterstock

The role of financial literacy

The study explored whether financial literacy influenced the decision to consult a financial adviser and whether financial literacy impacted decision confidence, stress and perceived decision complexity.

We used a financial literacy measure known as the ‘Big Three’ questions. You can do the quiz below. A person is defined as financially literate if they get three questions correct.

This measures literacy on inflation, interest rate, and risk diversification. We also asked respondents to rate their financial literacy.

We found:

-

nearly one-third of respondents were not certain the accommodation payment decision was the best for the resident financially

-

about 60 per cent of respondents found deciding on how to pay for accommodation complex, and more than half found deciding how to pay for accommodation stressful

-

less than half of all respondents were financially literate. Many were overconfident in their financial literacy, which could lead to worse financial outcomes for the resident.

Many respondents may have ignored complex information or used a mental shortcut (what researchers call ‘simplifying heuristics’) when making a decision. For example, they might sell their home and choose a RAD without considering the capital gain they could have received if they had kept the home.

Getting advice

Just over one-third of respondents used a financial adviser. More financial literacy was unlikely to have increased the use of a financial adviser. Highly financially literate people were more likely to use a financial adviser if they perceived their financial literacy as low.

Residential aged care providers also played a role. A respondent was more likely to use a financial adviser if the aged care provider suggested using a financial adviser, or informed them the resident had 28 days to make a payment decision once they entered care. While this condition should be in the final accommodation agreement, it may not be explicitly stated by the provider when discussing payment options.

We found higher financial literacy may help respondents understand the difference between a RAD and DAP, but was unlikely to increase decision confidence or reduce decision stress.

High financial literacy was associated with greater confidence only if respondents thought they had been given enough time to make the decision. This suggests some people could make better decisions if aged care providers gave people more time to make a decision.

Respondents with high financial literacy were also more likely to be confident in their decision if the aged care provider didn’t say whether it preferred the resident to pay a RAD or a DAP.

Shutterstock

So what would help?

It’s not possible to say whether RAD, DAP, or some combination of both is better; the answer depends on individual circumstances. Selling the home when entering care may not be the best option financially.

The Financial Information Service run by Services Australia can help people improve their financial literacy and how to use financial planning advice, but does not advise on which accommodation payment type is best.

Financial literacy education may help some people, but the study suggests the benefits will be limited.

Each resident has unique financial and personal circumstances. To make an informed accommodation payment decision, the future value of financial assets will need to be considered.

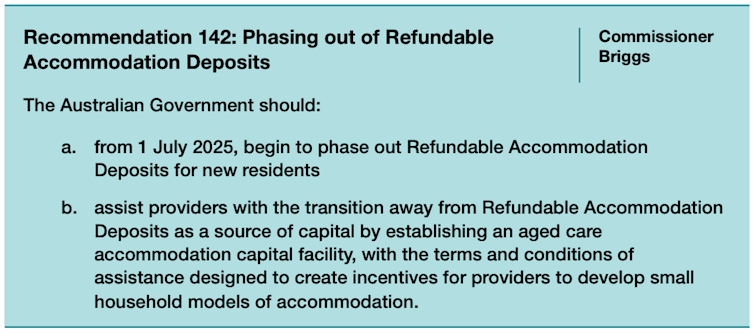

The Australian government is still exploring whether it should remove RADs, as suggested by the Royal Commission on Aged Care Quality and Safety. This would simplify the accommodation payment choice but may take years to implement.

https://agedcare.royalcommission.gov.au/sites/default/files/2021-03/final-report-recommendations.pdf

When discussing accommodation payment options, all residential aged care providers should ensure residents know they have 28 days to make a decision once they enter care.

That should help reduce decision complexity and stress and increase decision confidence.

Providers should also not express their preference for receiving a RAD or DAP as the study’s results show this can make the decision more complex and prompts people to have less confidence in their decision.

The Australian government should also consider subsidising access to financial advice or establishing its own financial adviser service.

This would align with other Australian government programs to improve health and wealth outcomes for older Australians, such as prostate, bowel and breast cancer screening and Life Checks.

When moving into residential aged care, good financial outcomes are as important.![]()

Henry Cutler, Director, Centre for the Health Economy, Macquarie University

This article is republished from The Conversation under a Creative Commons licence. Read the original article.

Did you pass the test? What’s been your experience with aged care systems? Have you found the decision process overwhelming? Why not have your say in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Is your “financial literacy test” a joke? Being able to answer such childishly obvious questions is not evidence of financial literacy, and suggesting otherwise may lull some people into a false sense of security.