YourLifeChoices asked the Federal Government, the Opposition and a key welfare organisation for their responses on whether the Age Pension was sufficient to meet the needs of retirees living on the edge.

The question

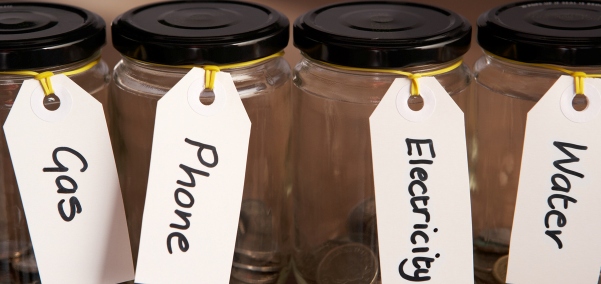

The current Age Pension, with supplements, for singles is $894.40 per fortnight. The YourLifeChoices Retirement Affordability Index™ has found that fortnightly expenditure for the cash-strapped single – that is, a person who rents – is $863.64. The situation for cash-strapped couples who rent is worse – a fortnightly pension each of $674.20 (with supplements) and a fortnightly expenditure each of $687.04. The drivers for the latest cost-of-living increase are fuel and power. Even with the modest rent assistance supplied, these retirees are living on the edge. What is the solution?

The answers

Spokesperson for the Department of Social Services

The Australian Government appreciates the important economic and social contribution that senior Australians make to our community and is keen to ensure that all pensioners’ living standards are safeguarded by the Age Pension system.

Pensions increase regularly. Base pensions are indexed twice a year – in March and September – to the higher of the two increases in the Consumer Price Index (CPI) and the Pensioner and Beneficiary Living Cost Index (PBLCI).

PBLCI was introduced to ensure pension indexation better reflects changes to pensioners’ costs of living. It takes into account the goods and services pensioners buy – not what the rest of the community buys. The PBLCI basket of goods and services is weighted to recognise that pensioners spend more of their income on essentials, including food, health, clothing, telephone calls and postage.

After indexing to price increases, base pension rates are then benchmarked to 41.76 per cent of Male Total Average Weekly Earnings for pensioner couples combined. The single rate of pension is two-thirds of the combined couple rate.

These arrangements ensure pension rates are more responsive to pensioners’ actual living cost increases and keep pace with community living standards as measured by wages.

Since 20 September 2017, maximum pension rates are:

- $894.40 a fortnight or $23,254.40 a year for singles;

- $1348.40 a fortnight or $35,058.40 a year for pensioner couples combined.

The YourLifeChoices Retirement Affordability Index™ has found that fortnightly expenditure for a single pensioner who rents is $863.64 and fortnightly expenditure for pensioner couples who rent is $687.04. The question compares these amounts to the fortnightly pension rates listed above.

However, pensioners who rent in the private rental market can also receive Rent Assistance. Single pensioners who live alone may be eligible for Rent Assistance of up to $133 a fortnight, while couples may be eligible for Rent Assistance of $125.40 a fortnight.

The question also mentions increases in costs of fuel and power. Where the costs of goods and services purchased by pensioners increase, these increases are reflected in the CPI and PBLCI, which are used to index pensions.

The Government provided a one-off Energy Assistance Payment to recipients of the Age Pension, Disability Support Pension and Parenting Payment Single, as well as to veterans and their partners who are paid the Service Pension, the Income Support Supplement or relevant compensation payment. The payment provided one-off assistance to those who have been impacted by recent increases in energy prices and who have limited ability to earn extra income to cover the additional costs while other energy reforms take effect. The rate of payment was $75 for singles and $62.50 for each eligible member of a couple and was received by the majority of recipients by 30 June, 2017. The payment is non-taxable and does not count as income.

For people who are struggling financially, Centrelink has social workers who can assist in several ways, including helping with claims for payments and providing information about, or referring customers to community support services, including the Commonwealth Financial Counselling Program.

The program provides confidential financial counselling services free of charge to people in low-income groups who are experiencing financial difficulty.

An appointment to see a social worker can be arranged by phoning Centrelink on 13 2850 for the cost of a local call. Calls made from mobile phones may incur additional costs.

Jenny Macklin, Shadow Minister for Families and Social Services

We can’t allow the Government to make any further cuts to the Age Pension.

Prime Minister Malcolm Turnbull and Treasurer Scott Morrison proposed axing the Energy Supplement in the 2016 Budget, but haven’t been able to get this through the Senate.

Axing the supplement would cost new single pensioners $14.10 a fortnight or $365 a year. Couple pensioners would be $21.20 a fortnight or around $550 a year worse off.

We also need to ensure we maintain the link between wages growth and pension indexation.

In the 2014 Budget, the Abbott Government tried to cut pension indexation by $23 billion over a decade. It would have seen the pension cut by $80 a week after 10 years.

On the issue of deeming rates, it has been nearly three years since the rates were adjusted.

Interest rates have fallen from 2.25 per cent in February 2015 to 1.50 per cent today, yet Mr Turnbull has done nothing.

Deeming rates are supposed to reflect returns across a range of investment choices available in the market, but the Turnbull Government has failed to act by lowering deeming rates. It is well past time that he acted, and brought them into line with real rates of return.

Labor understands that in today’s low interest rate environment, pensioners find it very difficult to get a reasonable rate of return on their savings.

The Turnbull Government should do the right thing by lowering the deeming rates to provide some relief to Australian pensioners.

Joel Pringle, Advocacy Campaigner, The Benevolent Society

Recent research by The Benevolent Society shows that people on the Age Pension who are renting are increasingly forced to choose between mashing food instead of seeing a dentist, or turning off the hot water system and dealing with the health consequences later. This is how people manage when the basic costs-of-living exceed their income.

Utilities are one factor in cost increases, but the running down of Commonwealth Rent assistance and social housing stocks are the greatest factors causing hardship in private rent.

Other factors that result in people doing it tough on the pension include illness and being or becoming single. In response, we hear governments blaming people for their circumstances – an attempt to shift responsibility from the fact that government decisions create the economies and society that we live in.

Addressing poverty and hardship are a priority.

Instead of tax cuts, the Government could bolster Rent Assistance or subsidise dental health care. Governments have politicised the Age Pension over many years, and the solution is to hold them accountable for it.

Related articles:

Age Pension inadequate

Universal Age Pension

Age Pension overseas