Half a million people intend to retire within the next five years. However, it’s unlikely that anyone is truly prepared for what lies ahead.

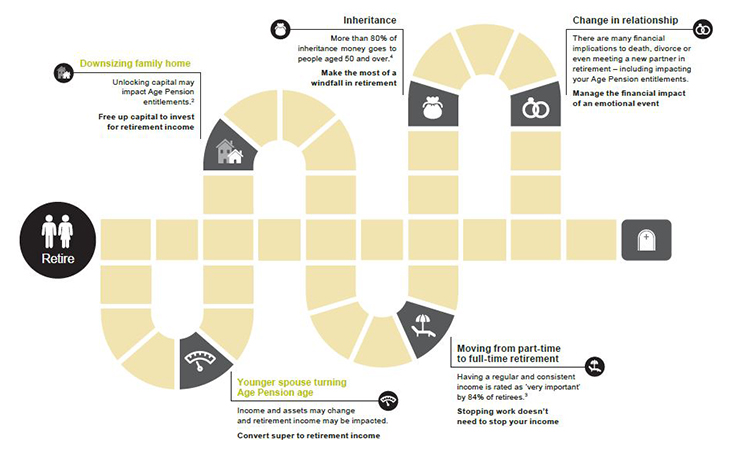

Life doesn’t always go to plan. Things change – markets can move the wrong way, relationships can break down, you may receive a sizeable inheritance or downsize your family home. Any change can have an emotional and financial impact, regardless of whether it’s planned or out of the blue.

In the first of two articles, we look at what to consider when a younger spouse turns Age Pension age, and the financial impacts of downsizing the family home.

Younger spouse turning Age Pension age

Converting super to income when your spouse turns Age Pension age.

One advantage of having a younger spouse when retirement is approaching is being able to split super and potentially increase the older spouse’s Age Pension. However, once the younger spouse hits Age Pension age, his or her retirement income strategy might need to change.

Considerations

Chelsea and Callum are homeowners. Callum turns Age Pension age so he begins drawing down on his super by converting it to an account-based pension.

Before speaking to their financial adviser, they wonder if they should:

- Consider gifting a significant amount to their children as a way of reducing their assessable assets despite not having clarity about the potential impact on their Age Pension.

- Rework their budget, and look at how they can spend less and save more, so they don’t have to worry so much about running out of money in retirement.

- Look at investing some of their super to produce retirement income to gain the certainty of having enough income for the rest of their lives.

When a younger spouse turns Age Pension age, super could be converted to provide retirement income. Contact your financial adviser to find out how a lifetime annuity could help you with income for life.

Downsizing

Moving to a smaller home shouldn’t shrink your retirement income.

There are a number of life changes that can impact retirement income – unlocking capital by downsizing is one that may affect your Age Pension entitlements.

Downsizing is a great way to free up capital for you to invest for retirement income. But downsizing can also impact your Age Pension entitlements. If you’re keen to make this move, your retirement plans may need to change as well.

Considerations

Cathy and Carlos are both 68 and have increased their total assessable assets from $400,000 to $700,000 by downsizing to a smaller home.

Before speaking to their financial adviser, they wonder if they should:

- Revisit their investment strategy and retirement income with a view to ensuring their retirement savings will last the distance.

- Put the money in a term deposit to avoid any risks associated with the stock market – even if it doesn’t earn much and might affect their Age Pension.

- Consider strategies and structures that could help boost their Age Pension.

Unlocking your capital by downsizing may impact your Age Pension entitlements, but it could also free up capital to invest. Contact your financial adviser to find out how a lifetime annuity could help you with income for life.

Part two in this series will be published on 30 September.

Challenger is a preferred partner of YourLifeChoices.

Have you reached retirement age but have a younger spouse? Were you aware of these considerations? Why not share your experience in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

2 Age Pension benefits will not apply to all individuals. Age Pension outcomes depend on an individual (or couple’s) personal circumstances and may change over time.

3 National Seniors Australia and Challenger, 2018, Once bitten twice shy: GFC concerns linger for Australian seniors, National Seniors, accessed April 2021.

4 Danielle Wood and Kate Griffiths, 2019, Generation Gap: Ensuring a fair go for younger Australians, Grattan Institute, accessed April 2021.

Disclaimer: This information is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger) and is current as at 26 May 2021. The information in this article is general only and has been prepared without taking into account any person’s objectives, financial situation or needs. Because of that, each person should, before acting on any such information, consider its appropriateness, having regard to their objectives, financial situation and needs. Scenarios, examples and comparisons shown are for illustrative purposes only. They should not be relied on by individuals when they make investment decisions. Each person should obtain and consider the relevant product’s Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold the relevant product. A copy of the relevant product’s TMD and PDS can be obtained from your financial adviser, our Investor Services team on 13 35 66, or at www.challenger.com.au Challenger Life is not an authorised deposit-taking institution for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an authorised deposit-taking institution in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provide assurance in respect of the obligations of Challenger Life. Accordingly, unless specified otherwise, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any Challenger ADI.