The latest threat to retirement income has long been a consideration for Aussie retirees, but perhaps never more so than right now.

Inflation is on the rise and with it comes the very real threat of ruining retirement plans.

From July 2022, superannuation funds are required to put strategies in place to help you manage inflation risk. This would involve managing expected inflation as well as the adverse impacts of unexpected increases in inflation.

The price of fresh produce, meat and many products and services has seen a sharp bump during the pandemic and money experts expect these increases to stick around indefinitely.

EY chief economist Jo Masters says that even if supply chain and workforce disruptions ease, consumers should prepare to keep paying higher prices for ‘sticky-down’ goods and services such as home maintenance and healthcare, fresh produce and meat.

Read: Can you expect prices to come down after Omicron increases?

“A large number of the items driving the rise in inflation lately are items that are sticky-down and therefore unlikely to have a deflationary contribution, even once supply chain issues are resolved,” says Ms Masters.

“The easing of supply chains is unlikely to drive aggregate prices lower, although it will slow the rate of price inflation. In other words, resolving the supply disruption is more likely to be disinflationary than deflationary.”

This rising costs of goods and services will reduce the purchasing power of a retiree’s income if not managed, says head of retirement research at Challenger Life, Aaron Minney.

Read: Supermarket prices to rise even further as COVID inflation hits

“Retirees need a source of income that adjusts to inflation in order to sustain a stable lifestyle throughout retirement,” writes Mr Minney for Money Management.

“Inflation risk arises because the level and impact of future inflation is unknown. Inflation expectations can be factored into a retirement income strategy, but there needs to be a plan for what happens if inflation does not match the built-in expectations.”

How inflation will affect retirees

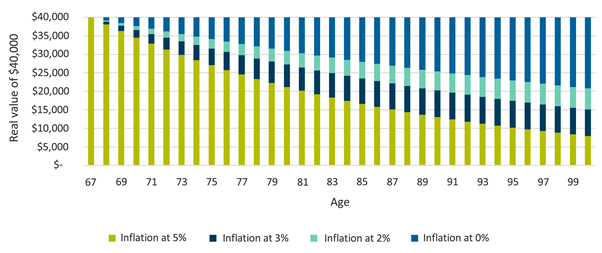

Even modest rates of inflation will hamper a retiree’s lifestyle, says Mr Minney.

“With inflation of only 2 per cent a year, one-quarter of the value of the nominal income is lost after only 14 years. The risk of higher inflation is stark – 5 per cent a year would halve the value of payments over the same period.”

This can have a severe impact on a retiree’s lifestyle, but research by David Blanchett in the US and the Grattan Institute shows some reduction in lifestyle quality may be acceptable, as retirees usually spend less over time.

“However, the fall in spending is typically less than inflation, which means that nominal spending increases,” says Mr Minney.

“Even if a decline in living standards is intentional (i.e., less spending on discretionary items), retirees still need to manage inflation to afford the lifestyle they desire.”

How can retirees protect against unexpected inflation risks?

Guarding accumulating savings from unexpected inflation requires returns that offset the inflation. Equities may provide these returns and unlisted property can benefit should property prices increase during inflationary periods.

Bond investments may help, but they are also more exposed to inflation because the yield to maturity doesn’t change after purchase unless they are specific CPI-linked bonds.

“The price they pay, and the yield they demand, will depend on the inflation rate that they expect in the future,” says Mr Minney.

Since the mid 1990s, expected inflation has fallen in the Reserve Bank of Australia’s (RBA) target band of 2 to 3 per cent, meaning RBA policies have been able to mitigate or manage inflation risk in this time.

Read: Inflation predicted to soar, putting retirements at risk

But what of managing the unexpected rates we currently face?

Lower than expected inflation means a higher living standard. The reverse situation has been coined as the ‘known unknown’ because no-one actually knows how it will play out until after the fact

“Managing this takes more than just high returns,” says Mr Minney. “After all, they might not be high enough. What retirees need is an investment that benefits from higher inflation, or even better, automatically adjusts through a linkage to the CPI.”

Can retirees protect themselves from inflation?

Super funds will need to have a retirement income strategy that considers and manages inflation risks, as per the Retirement Income Covenant ruling.

“The first part of this strategy is likely to involve the Age Pension,” says Mr Minney. “Many retired fund members will receive at least a partial Age Pension in retirement. This helps manage inflation risk because it is automatically adjusted for inflation. The full Age Pension actually tracks average wages over time, which typically grow more than inflation.”

In order to protect against inflation, funds may also need to consider members’ spending needs at different retirement stages.

“As noted, some discretionary spending drops off at older ages, so inflation on this consumption might be okay with less protection,” says Mr Minney.

“However, it is important to have some inflation cover for the essential components of a retired member’s lifestyle. Members with only a part Age Pension, or those who receive no Age Pension, could benefit from an investment that explicitly manages this risk, by protecting against higher-than-expected inflation.”

So far, super funds safeguard nest eggs by growing accumulation assets faster than inflation. However, Mr Minney says there will be an additional requirement on super funds to consider inflation risk for retired members.

“Like many aspects of retirement, inflation risk is slightly different when generating retirement income, but funds can deliver better (inflation-adjusted) outcomes for their members by using some inflation-linked assets in addition to investments with high expected returns,” he says.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.